Money and Benefits

Unemployment Benefit II / Social Allowance

The unemployment benefit II and the social allowance are part of the benefits to secure a livelihood and ensure a decent level of living. Both will only be granted if you are not able to work or eligible to receive other social benefits.

Further information on other services that are of primary importance for you can be found on the "Priority Services" tab.

There are obligations attached to the receipt of unemployment benefit II. These obligations include, for example, active job seeking and making personal efforts in order to get employed.

The unemployment benefit II and the social allowance include not only the basic needs, but also the reasonable requirements for accommodation and heating, as far as these requirements are not covered by income or assets.

Basic needs

The basic needs for securing a living include, in particular, requirements for nutrition, clothing, personal hygiene, household effects, household energy (without heating and hot water) as well as needs for participation in social and cultural life.

Adults (single people, parents and applicants whose spouses are minors) are entitled to receive regular benefits. Adults who are grown children of other applicants have to hand in their own application. Adults up to an age of 25 who are living with their parents are considered to be a part of a community of need.

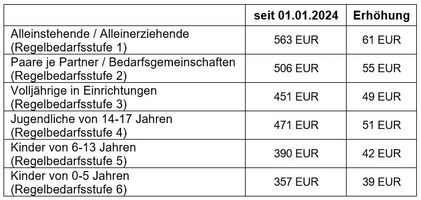

The amount of the decisive basic need is shown in the table below.

Statute for reasonable accommodation costs

The Vogelsbergkreis has made use of the statutory authorization of the state of Hesse to issue statutes to determine reasonable accommodation costs. In its meeting on 12/07/2012 the district council determined the "Statute of the Vogelsbergkreis to the appropriateness of the expenses for the accommodation in the SGB II and in the SGB XII area". It came into force on 01/01/2013. Most recently, the district council adopted an amendment statute in a meeting on 11/05/2018.

The currently applicable directive, which incorporates the changes as of 01/01/2019, can be viewed here.

Click here to view a short overview with the important rental value tables valid as of 01/01/2019 and a list of special needs.

Insofar as you receive current benefits for the basic security for jobseekers and the contents of the articles of association affect your receipt of benefits, you will be informed accordingly by the KVA. If you have any further questions, you are also welcome to contact your responsible benefits representative.

What services does the education package include?

Lunches

Indigent children can apply for a grant for lunch in kindergarten or school.

Day trips and school trips

For students and children visiting a day care facility, the cost of one-day excursions and multi-day school trips can be covered.

School supplies

€150 per year can be granted so that indigent children are equipped with the necessary learning materials:

€ 100 at the beginning of the school year and € 50 for the second half of the school year. Semester. These amounts will be adjusted as of 2021.

Culture, sport, membership

Children and young people under the age of 18 can claim a monthly allowance of € 15. For example, for membership in a sports club, extracurricular music lessons or participation in recreational activities.

Learning support

Indigent students can apply for learning support if the achievement of essential learning goals is jeopardized. The condition is that the school confirms the need and that there are no comparable educational provisions already in place.

School transportation

As of the second year in a vocational school, the costs of attending the nearest school can be covered.

Who is eligible for the services?

Children are entitled from families who receive

- Social allowance according to SGB II

- Social assistance according to SGB XII

- Housing benefits

- Children's allowance

- Benefits according to the Asylum Seekers Benefits Act.

The educational package can be used by children as well as students up to the age of 25 years. Benefits for participation in social and cultural life will continue until the end of the 18th years of age.

Young people and young adults receiving educational benefits are not eligible to receive any further benefits.

Here are the applications for the educational package

Insofar as benefits are received under SGB II, SGB XII or the Asylum Seekers Benefits Act, education and membership benefits will be applied for automatically.

Beneficiaries of the child allowance and housing allowance must submit separate applications for education and membership benefits.

A separate application is required in each case for learning support services.

You can download the application and attachments at our service points in Lauterbach/Alsfeld.

For questions about the educational package, our employees can be contacted at:

Phone: 06641 977 - 2120 or 06641 977-2121

Fax: 06641 977 - 478

E-Mail: bildungspaket(at)vogelsbergkreis.de

Strong Families - Information from the Federal Ministry for Family Affairs, Senior Citizens, Women and Youth

What state support do families receive?

What services are available for low-income families?

What are the main family benefits and how can I apply for them?

The Federal Ministry for Family Affairs, Senior Citizens, Women and Youth has provided information here.

In individual cases, beneficiaries have an increased need due to special living conditions, which is not covered by the basic needs. In this case, beneficiaries can receive additional benefits. The following persons may be entitled to an additional benefit:

- expectant mothers after the 12th week of pregnancy

- people with disabilities, provided they receive benefits for participation in working life according to the Social Security Code, Book 9 (SGB IX)

- people who rely on a more cost-intensive diet for medical reasons

- additional hot water needs, insofar as hot water is generated by devices installed in the cost of the accommodation (decentralized hot water production)

- as far as in an individual case there is an unavoidable, ongoing, not only one-off special need, for example costs of exercising the right of access with the child

A person is eligible to receive benefits according to SGB II only as far as he is not able to help himself, e.g. through the use of his own workforce or by receiving other social benefits. If you are entitled to other social benefits, these benefits have to be applied for and claimed as a matter of priority. Such so-called priority benefits are credited towards their entitlement to unemployment benefit II or social allowance in order to avoid, reduce or terminate your need for assistance.

Priority services are include:

- Old-age pension

- Unemployment benefits

- BAföG

- Vocational Training Allowance (BAB)

- Parental benefits

- Disability pension

- Half and full orphan's pension

- Child benefits

- Child allowance

- Sick benefit

- Maternity benefit

- Alimony advance

- Widow’s pension

- Housing benefit

Income

If you submit an application for benefits according to SGB II (unemployment benefit II), not only your income and financial circumstances will be considered, but also all those of all members of your community of need.

Income generally includes all income or payments which are received by you and the members of your community of need during the approval period, such as:

- Earned income

- Freelance income

- Additional income from a "€ 450 job"

- Additional salary payments from previous or terminated employments

- Christmas and holiday payments

- Special or performance bonuses

- Shift allowances and overtime pay

- Unemployment benefit or sick benefit

- Tax refunds

- Operating cost reimbursements from the tenancy

- Maintenance payments

- Housing allowance / rent subsidy

- Maternity benefit that was not counted towards your parental allowance

- Child benefit

- Capital and interest income, distributions or participations

- Revenue from letting and leasing

- Lottery winnings, other income (also one time revenue)

- Inheritances

Assets

Assets are all usable assets that you and the members of your community of need own, such as

- Cash

- Bank deposits

- Shares and savings bonds

- Savings contracts

- Etc.

The following are not considered as assets, for example:

- Adequate household goods

- A suitable motor vehicle for each employable person living in the community of need

- A self-used house plot of adequate size or a corresponding condominium

- Property and according rights, as far as their recovery is obviously uneconomical or would mean a particular hardship

The living conditions during the receipt of the benefits to the basic security for jobseekers are decisive to determine appropriateness.

If you have any further questions regarding the consideration of income and assets, you can contact our service center or your relevant service provider.

As long as you receive benefits according to SGB II, contributions to the sick and long-term care insurance will be paid. Long-term care insurance payments will be transferred monthly directly from the KVA Vogelsbergkreis – (local employment agency) to the social insurance provider.

A compulsory insurance in the statutory pension insurance cannot be simultaneously paid with the receipt of benefits according to SGB II. However, the time of receipt is transmitted to the pension insurance by the KVA Vogelsbergkreis - communal employment agency. The pension insurance provider then checks whether a credit period exists. In this way, gaps in the insurance biography can be avoided and, in particular, existing entitlements to disability pensions and benefits for participation can be maintained.

The information on reduction on benefit is currently being revised due to a recent ruling by the Federal Constitutional Court.

Updated information on reduction on benefit will be published soon.